FamPay: A Comprehensive Guide to the Digital Financial Platform for Gen Z

Related Articles: FamPay: A Comprehensive Guide to the Digital Financial Platform for Gen Z

Introduction

With great pleasure, we will explore the intriguing topic related to FamPay: A Comprehensive Guide to the Digital Financial Platform for Gen Z. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

FamPay: A Comprehensive Guide to the Digital Financial Platform for Gen Z

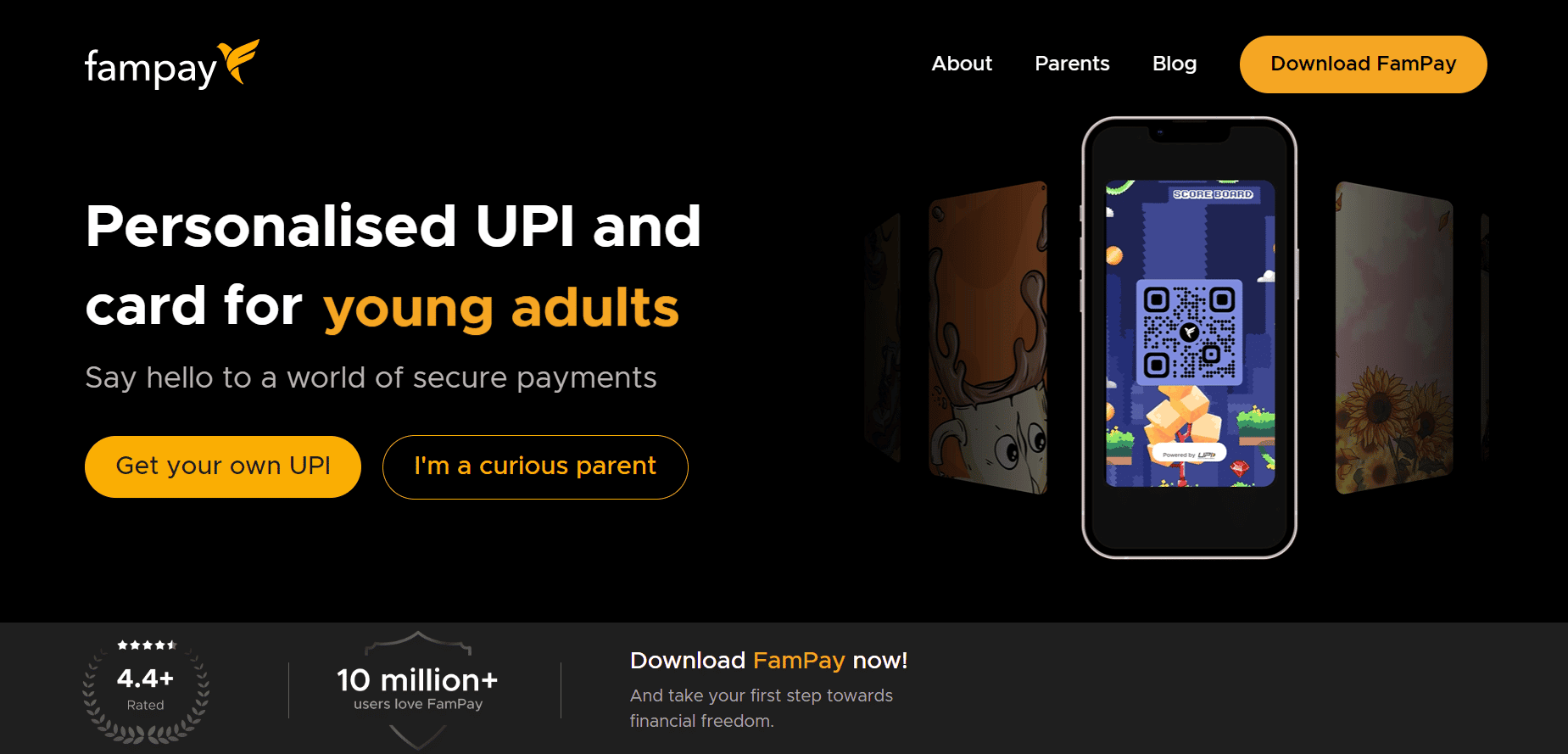

In the rapidly evolving landscape of digital finance, the emergence of platforms catering specifically to younger generations is a notable trend. FamPay, a financial technology company, stands out as a prime example, focusing on providing a secure and user-friendly platform for Gen Z to manage their finances. This article delves into the multifaceted aspects of FamPay, examining its features, benefits, and impact on the financial landscape.

Understanding FamPay: A Digital Wallet for the Modern Generation

FamPay is a digital payments and financial services platform designed to empower young adults with the tools they need to navigate the digital world of money. It operates as a digital wallet, offering a seamless and secure way to make payments, transfer funds, and manage expenses. The platform’s intuitive design and user-friendly interface cater specifically to the digital fluency of Gen Z, making financial management accessible and engaging.

Key Features and Benefits of FamPay:

1. Seamless Payment Experience:

FamPay facilitates effortless payments through its integrated QR code scanning technology. Users can easily scan and pay at various merchants, including online and offline stores, making transactions swift and convenient. The platform also supports UPI (Unified Payments Interface), enabling instant money transfers between bank accounts.

2. Pre-Paid Card for Secure Spending:

FamPay offers a virtual pre-paid card that can be used for online and offline purchases. This feature provides a secure and controlled spending environment, allowing parents or guardians to set spending limits and monitor their child’s financial activity.

3. Financial Literacy and Education:

Beyond transactional capabilities, FamPay prioritizes financial literacy. The platform provides educational resources and insights to help young users understand the fundamentals of money management, budgeting, and responsible spending habits.

4. Gamified Experience for Engaging Financial Management:

FamPay employs gamification techniques to make financial management more engaging and enjoyable for young users. Users earn rewards and points for completing tasks and achieving financial goals, fostering a positive and interactive approach to managing their finances.

5. Secure and Transparent Platform:

FamPay places paramount importance on security and transparency. The platform employs robust security measures, including multi-factor authentication and encryption, to protect user data and transactions.

The Impact of FamPay on the Financial Landscape:

FamPay’s emergence has significant implications for the financial landscape, particularly in shaping the financial habits of Gen Z. The platform’s focus on user-friendliness, financial education, and gamification fosters a positive and engaging relationship with finances, encouraging responsible financial behavior from a young age.

FamPay’s Role in Financial Inclusion:

FamPay plays a vital role in promoting financial inclusion by providing access to financial services for individuals who may not have traditional bank accounts. The platform’s digital nature eliminates geographical barriers, allowing users to access financial services from anywhere with an internet connection.

FAQs on FamPay:

1. How do I create a FamPay account?

To create a FamPay account, individuals need to download the FamPay app from the Google Play Store or Apple App Store. They can then follow the on-screen instructions to register and verify their identity.

2. Is FamPay safe and secure?

FamPay prioritizes security and employs robust measures to protect user data and transactions. The platform uses multi-factor authentication, encryption, and other security protocols to ensure the safety of user information.

3. What are the fees associated with using FamPay?

FamPay offers a variety of services, some of which may be subject to fees. The specific fees associated with different services are clearly outlined in the FamPay app and on the company’s website.

4. How can I contact FamPay customer support?

Users can reach out to FamPay customer support through the in-app support feature, email, or phone. The company’s contact information is available on the FamPay website.

5. What are the age restrictions for using FamPay?

FamPay is designed for individuals aged 15 and above. Users under the age of 18 may require parental consent to open an account.

Tips for Using FamPay Effectively:

1. Set Spending Limits:

Users can set spending limits on their virtual pre-paid card to control their expenses and prevent overspending.

2. Utilize Financial Education Resources:

FamPay offers a range of educational resources to help users develop their financial literacy. Take advantage of these resources to learn about budgeting, saving, and investing.

3. Monitor Spending Patterns:

FamPay provides detailed transaction history, enabling users to track their spending patterns and identify areas where they can improve their financial habits.

4. Take Advantage of Rewards and Incentives:

FamPay offers rewards and incentives for completing tasks and achieving financial goals. Leverage these opportunities to motivate yourself and enhance your financial management skills.

5. Consider FamPay’s Business Solutions:

FamPay also offers business solutions for merchants, enabling them to accept digital payments and manage their finances more efficiently.

Conclusion:

FamPay stands as a testament to the evolving landscape of financial technology, catering specifically to the needs and preferences of Gen Z. By providing a user-friendly, secure, and engaging platform for managing finances, FamPay empowers young adults to embrace financial responsibility and navigate the digital world of money with confidence. The platform’s focus on financial education and inclusion makes it a valuable tool for promoting responsible financial habits and fostering a more inclusive financial system. As the digital financial landscape continues to evolve, FamPay is poised to play a significant role in shaping the future of financial services for younger generations.

Closure

Thus, we hope this article has provided valuable insights into FamPay: A Comprehensive Guide to the Digital Financial Platform for Gen Z. We hope you find this article informative and beneficial. See you in our next article!